In today’s rapidly evolving financial landscape, non-traditional lending solutions have gained significant popularity. While traditional bank loans still exist, businesses and individuals are increasingly turning to digital lending platforms for faster, more flexible options.

These platforms have revolutionized lending by removing the need for extensive paperwork and long approval processes, enabling quicker access to funds.

Digital lending platforms streamline the entire loan process—from credit assessment to repayment—by leveraging automation and AI technology. This approach not only improves the speed of operations but also enhances the accuracy of decisions, benefiting both lenders and borrowers.

For businesses, this means having access to tailored lending solutions that can scale with their needs, whether it’s for personal loans, business growth, or specific sectors like real estate and microfinance.

The following sections explore the types of lending available today and how businesses can choose the right lending solution.

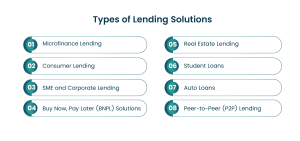

Types of Lending Solutions

1. Microfinance Lending

What it offers: Small-scale loans aimed at businesses that lack access to traditional financial services. These platforms focus on financial inclusion and help small businesses, particularly in underserved markets, grow by providing them with much-needed capital.

When to choose this: If your business operates in developing markets or targets underserved communities with small, low-risk loans, a microfinance platform is ideal. This is also a good fit for startups or entrepreneurs looking to support financial inclusion.

2. Consumer Lending

What it offers: A platform that automates the management of personal loans, handling tasks like loan applications, credit scoring, approvals, and repayments. Common use cases include loans for home renovations, debt consolidation, and medical expenses.

When to choose this: Opt for a consumer lending platform if your financial institution provides personal loans for consumer needs and you want to streamline the process, making it faster and easier for borrowers to apply and for lenders to approve.

3. SME and Corporate Lending

What it offers: Automates the process of underwriting and managing loans for small and medium-sized enterprises (SMEs), helping businesses access funding for working capital, equipment purchases, or expansion.

When to choose this: Choose SME lending if your organization primarily lends to SMEs or larger corporations, and you need a platform capable of handling complex, higher-value loans while automating credit checks and management.

4. Buy Now, Pay Later (BNPL) Solutions

What it offers: Enables retailers to offer installment-based payment options, allowing consumers to spread out payments while integrating seamlessly with e-commerce platforms. BNPL automates the entire loan management and repayment process.

When to choose this: Opt for BNPL if you run an e-commerce platform or retail business and want to boost sales by offering customers flexible, installment-based payment options to enhance their shopping experience.

5. Real Estate Lending

What it offers: Provides a platform for managing real estate loans, including residential mortgages and commercial property financing. The system handles loan origination, property evaluations, interest calculations, and other key aspects of real estate lending.

When to choose this: If your business involves real estate or property financing, a real estate lending platform is essential for efficiently managing large, secured loans, ensuring accurate property assessments and financial management.

6. Student Loans

What it offers: Simplifies the loan application process for students, streamlines repayment schedules, and provides tools for tracking loans, helping both borrowers and lenders stay organized.

When to choose this: A student loan platform is ideal for educational institutions, government agencies, or financial firms providing education funding, as it simplifies complex repayment plans and makes tracking student loans easier.

7. Auto Loans

What it offers: Manages vehicle financing from loan origination through to repayment, ensuring smooth transactions between borrowers and auto dealers.

When to choose this: If your business provides loans for vehicle purchases, an auto loan platform will help streamline the entire process, ensuring fast and efficient financing for borrowers and dealers alike.

8. Peer-to-Peer (P2P) Lending

What it offers: Facilitates direct lending between borrowers and lenders, bypassing traditional financial institutions. This often results in competitive interest rates and increased transparency for both parties.

When to choose this: If your platform is focused on connecting borrowers directly with individual lenders

Choose the Right Lending Solution For Your Business

- Understand Your Lending Needs

Business size, loan types, and customer needs dictate the right platform. - Customization & Flexibility

Adaptable repayment terms, loan products, and credit assessments. - Automation & Speed

AI-powered tools streamline credit checks, approvals, and disbursements. - Regulatory Compliance

Ensure compliance with local and international laws like SAMA or GDPR. - Integration Capabilities

Seamless integration with CRM, accounting, or existing systems. - Analytics & Reporting

Real-time insights and automated reports to optimize lending operations. - User Experience

Easy-to-use platforms for both lenders and borrowers enhance customer satisfaction.

How to Choose the Right Lending Solution for Your Business

With so many lending options available, selecting the right solution for your business is crucial for ensuring growth, efficiency, and a smooth customer experience. Here’s what to consider:

1. Understand Your Lending Needs

- Identify Your Business Size: Determine whether you’re a small startup, an SME, or a larger corporation. The size of your business will dictate the complexity of the lending platform you need. For example, smaller businesses might benefit from microfinance or P2P lending, while larger enterprises may need more comprehensive corporate lending solutions.

- Type of Loan: Consider the nature of your financing needs. Are you looking for consumer loans, real estate financing, or auto loans? Pinpointing the exact type of loan your business offers will help narrow down the right platform.

2. Customization and Flexibility

- Adaptability: Choose a platform that allows for customization based on your specific lending model. Some solutions offer flexible repayment terms, adjustable loan products, and tailored credit assessments, enabling your business to cater to a variety of borrower needs.

- Scalability: Ensure that the lending platform can scale with your business. As your customer base grows, your lending system should be able to handle higher volumes without compromising efficiency.

3. Automation and Speed

- AI-Powered Automation: Automation tools can dramatically reduce the time it takes to approve loans, assess creditworthiness, and disburse funds. Platforms that leverage AI can streamline these processes, improving both speed and accuracy. This is particularly important for lending solutions such as BNPL or consumer loans where fast decisions are crucial.

- Operational Efficiency: Look for systems that reduce manual work, making your overall loan management more efficient. Automation helps cut down costs and improves the overall borrower experience.

4. Regulatory Compliance

- Compliance with Global and Local Regulations: Financial regulations vary by region. Ensure that the platform complies with local laws, such as SAMA (Saudi Arabian Monetary Authority) guidelines in Saudi Arabia or GDPR in Europe. Non-compliance can lead to significant fines and a loss of trust among borrowers.

- Data Security: Cybersecurity is vital in protecting sensitive borrower information. Choose platforms that prioritize secure payment gateways, encryption, and secure data storage to protect against potential breaches.

5. Integration Capabilities

- Seamless Integration with Existing Systems: Whether it’s your CRM or accounting software, ensure that the lending platform can integrate smoothly with your current systems. This will help avoid redundancy and streamline workflow.

- Cloud-Based vs. On-Premise Solutions: Many lending platforms are now cloud-based, offering flexibility in remote access and scaling. Cloud-based platforms allow businesses to grow without the need for heavy on-premise infrastructure.

6. Analytics and Reporting

- Data-Driven Decision Making: A robust lending platform should provide real-time insights into loan performance, borrower risk levels, and repayment trends. Analytics help lenders make better decisions, optimize operations, and increase profitability.

- Automated Reporting: Look for platforms that offer built-in reporting tools to stay compliant with regulatory bodies. Automated reports save time and reduce the risk of errors.

7. User Experience

- Ease of Use for Borrowers and Lenders: The platform should be user-friendly for both borrowers applying for loans and the internal team managing the operations. A streamlined interface ensures a positive experience for all stakeholders.

- Customer Support: Ensure the platform offers reliable customer support, including training for your team and technical assistance when needed.

8. Cost and ROI

- Pricing Structure: Consider the cost of the platform, including setup fees, transaction fees, and any additional charges for advanced features like data analytics. Ensure the pricing aligns with your budget.

- Return on Investment: Analyze how much time and money the platform will save your business in the long run. A platform that reduces loan processing time can lead to increased revenue and borrower satisfaction.

Conclusion

Choosing the right lending platform is a crucial decision that impacts your business’s growth, customer experience, and operational efficiency. Whether you need a peer-to-peer lending platform, a BNPL solution, or real estate loan management, the platform you choose must align with your business’s unique requirements. From regulatory compliance to automation and scalability, a well-chosen platform will set the stage for long-term success.

For businesses seeking a comprehensive solution, LendX offers a flexible, AI-powered platform that supports various types of loans, including microfinance, corporate lending, and P2P lending. With built-in tools for automation, compliance, and reporting, LendX can help you streamline your lending operations and meet the growing needs of your borrowers.